.jpg?width=4005&name=AdobeStock_346979702%20(1).jpg)

Want to grow your business? Take smarter risks

Receivable management

Growing and building a successful company requires business leaders to take risks. However, it’s important to know which risks have a greater chance of success, and therefore a greater chance delivering your company’s growth aspirations.

__________________________________

For your business to keep growing, never has it been more important to assess risk accurately.

_________________________________

Knowing how to assess and anticipate risk is a key challenge for companies. For example, when the sales team bring in a new buyer, how can you know whether that buyer is safe to trade with and what credit terms to set? Or perhaps your sales team has identified a chance to expand into a new territory or sector, but you don’t have a clear understanding of the local marketplace.

This task is made even more difficult when the economic environment is unstable. Thanks to strong government financial support during the Covid 19 pandemic, companies had extra protection from the downturn in the economy, which has meant fewer companies falling into insolvency than otherwise would have been the case.

But as that government backing is withdrawn and new economic shocks emerge - such as the war in Ukraine or rising levels of inflation - they bring new, surprise risks for your business and your customers. And as the decision of global cosmetics giant Revlon to file for bankruptcy shows us, these shocks can affect big companies as well as small ones.

Unfortunately, our research shows the danger of late or non-payment is rising in Asia, with 93% of companies reporting receiving late payments and 50% of B2B credit sales overdue, according to the Atradius 2022 Payment Practices Barometer.

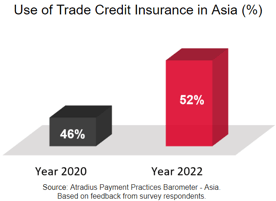

It’s no wonder then that more and more companies in Asia are adopting trade credit insurance as a risk management tool with the report also showing 52% of business in the region now have trade credit insurance coverage, up from 46% in 2020.

Given the ongoing uncertainty in the market, we don’t expect the bad debts trend to recover quickly. The anxiety about the longer time it takes business to collect overdue payments from B2B customers remains acute. The credit management processes of companies will be put to the test, and those businesses which have a flexible and holistic approach to the issue will be better well placed to navigate the troubled waters that may lie ahead.

So, for your business to keep growing, never has it been more important to assess risk accurately.

How well do you know your buyers’ risk profile?

Given the uncertain outlook, it’s important that your company is prepared for the unexpected which is why accurately evaluating customer risk is one of the most important tasks when it comes to growing a business and reducing the chance of non-payment. However, to do it properly is both a time consuming and costly process that should include visits to the buyer, analysis of financial statements, and research into the company’s payment history and key personnel, among others.

As Albirich Tang, Regional Head of Risk for North Asia and South China at Atradius explains: “Financial information is the first and the most logical area any credit expert would look at when assessing a company. But companies cannot just look at the financial statements and make a decision. They need to look at the entire picture and I would say now more than ever there is a bigger emphasis to look at the soft information attached to the buyer especially in Asia where obtaining financial statements is not always possible. A key area of assessment is the trading experience which gives us a good understanding if the buyer is historically a good payer.”

__________________________________

Accessing and managing buyer credit risk is an ongoing and constant process.

_________________________________

However, the time required to carry out such detailed assessments takes attention away from other critical business decisions and can reduce productivity.

Delays to making a credit assessment can also hurt relationships with new and existing customers. If it takes a long time to reach a decision about extending credit to a buyer, they may see it as a sign you don’t want to trade with them or that you mistrust their business.

In addition, an ineffective credit risk management process can damage the morale of your sales team who will lose confidence in generating new business leads if the credit risk process ends up hurting customer relationships and reducing sales opportunities.

It’s also important to note that the process of assessing credit risk does not end when the research is finished. Once a decision is made to grant credit to a buyer, you need to have the confidence that the terms you set are accurate. Your company will also need to regularly review those limits in response to the changing economic backdrop and the financial performance of the buyer. Far from being a one-time decision, assessing and managing buyer credit risk is an ongoing and constant process.

AI-powered credit risk assessments

Given the complex and time-intensive nature of credit risk assessment, many companies turn to Atradius’s trade credit insurance to help them. As a trade credit insurer, we provide businesses with the support, processes and tools to accurately and promptly assess buyer and market risk.

We combine the best technological tools with on-the-ground expertise to help companies likes yours enhance their credit control polices, freeing you to focus on managing cash flow and payments, growing the business and taking advantage of new opportunities.

Advanced technology plays an important role in how Atradius supports companies. We use artificial intelligence (AI) to carry out important tasks such as retrieving and processing information in order to optimise risk, explains Atradius’s Stan Chang, Director of Group Buyer Underwriting. “We use web scrapers, APIs and various associated technologies to pull in information in real time. It is information that is published in hundreds of thousands of websites, in multiple languages, on a 24/7 basis.”

With these technologies, we can identify information that is extremely valuable when assessing credit risk. That information can include data about M&A transactions, changes in management, payment defaults, the launch of new products, job advertisements, sanctions, litigation, labour strikes and other developments that provide insights to the ability of companies to fulfil their credit commitments.

If you’re a business looking for external finance to help you invest in business growth, trade credit insurance may help you access funding. Some banks and lending organisations look more favourably on businesses that have insured their accounts receivables.

Once the data is extracted, we feed it through natural language processing models, which we have developed in house from AI technology, and through machine learning systems. The information is classified and the system performs sentiment analysis, which takes into account subjective information. The data is also matched and compared with massive amounts of related information stored in our databases.

Alongside the ability to process large amounts of news and qualitative information, we also use AI to detect drivers that cause non-payment. "This way, we are issuing more decisions to support trade and getting them out faster," adds Chang.

__________________________________

"...we are issuing more decisions to

support trade and getting them out faster."

_________________________________

Delivering business intelligence and growth

It’s important for companies to grow, even in a tough economic environment. But while there are many markets that could provide opportunities for your business, where those opportunities are, depends on many factors. For example, what’s your product and is there a gap in the market? Can you differentiate your offering from the products already available? What’s your position in the supply chain?

This is another area where Atradius can support your company. Not only does working with us save you time and money but we can also help you identify new markets, customers and sectors, as well as highlighting both the opportunities and the risks for your business. We have a large team of experts who are on hand to provide you with in-depth sector knowledge and have extensive on-the-ground experience of markets across the world. For example, in Asia and Middle East alone, Atradius has 100 risk management experts or underwriters across 12 different markets while globally, we operate in 54 countries, which means our experts can conduct visits to buyers to assess credit risk as well as using publicly available information and our AI technology.

And from this combination of local market expertise and advanced technology like AI, we have created a database which hosts constantly updated information on more than 250 million companies around the world, providing a holistic view of the complex web of global supply chains: where a company falls along these supply chains; who a company sells to and buys from, giving us an in depth picture of a company’s risk profile. As well as being an important resource, it means that when you work with us, we already have a wealth of information on the customers you want to sell to and the markets in which they operate.

Our team of researchers also regularly publish in-depth research reports that will help you make informed decisions for your business. The reports include economic outlooks – global, regional and by market - and the prospects for key industries. We also produce reports on payment trends which include information on payment terms, the time it takes to collect invoices, managing payment delays, the impact of payment delays on business, and expected business trends by country and by industry sector.

Unlocking finance opportunities

If you’re a business looking for external finance to help you invest in business growth, trade credit insurance may help you access funding. Some banks and lending organisations look more favourably on businesses that have insured their accounts receivables.

Trade credit insurance improves your financial profile in a number of ways. For instance, it reduces your debt concentration risk which makes your company seem more creditworthy. In addition, the coverage provided by trade credit insurance increases the pool of receivables that will be considered ‘eligible’ by your lender and can often include foreign receivables. “Credit insurance is seen by banks as improving your company’s robust risk management, which means you can access better and cheaper financing to support business growth,” says Maria Sandhu, CEO of Atradius Singapore.

The bottom line is that many lenders believe businesses with credit insurance are more likely to have a healthy cash flow and will be better placed to meet loan repayment deadlines.

Protection when the worst happens

Importantly, when you are covered by our trade credit insurance, in the event the worst does happen and a buyer fails to pay, your losses are covered by us and can be recouped through the insurance policy.

This is no small thing. If you are handling contracts worth thousands or even millions of dollars, a bad debt or delayed payment could put a serious strain on your cash flow. Compensation for the loss through your credit insurance policy could signal the difference between business continuity and insolvency.

In the event one of your customers does not pay on time, our professional debt collection team - Atradius Collections - will seek to recover the outstanding payment. Our debt collection services are included as part of your insurance cover so there will be no extra cost to your business (excluding local taxes). And we can support you wherever you are in the world with our teams of locally-based multilingual Collections specialists.

If debt collection is not possible or your customer is insolvent, we will pay your claim so that your cash flow is secure.

“If your focus is on growing your business then credit insurance can help by insuring your

non-payments. Trade credit insurance protects your receivables, but another added value is the confidence you gain in expanding your business to new markets and customers. You’re transferring your risk to us and you’re also accessing our huge team of risk analysts and economists across the globe, to support your decision making,”

Supporting you across Asia

Atradius has a strong presence in Asia, bringing a wealth of international trading experience to the region since 2000. From our offices and through our co-operation with local partners in Asia, we provide the highest level of credit management and trade support.

To start protecting your business and take smarter risks:

Contact us for a free consultation

All content on this page is subject to our Disclaimer, available here.

%20(1).jpg?width=56&name=RoelandPunt_BlackandWhite_lr%20(1)%20(1).jpg)

-min%20(1)%20(1)%20(1)%20(1)%20(1).jpg?width=727&name=AdobeStock_317392639-min%20(1)-min%20(1)%20(1)%20(1)%20(1)%20(1).jpg)

%20(1).jpg?width=66&name=RoelandPunt_BlackandWhite_lr%20(1)%20(1).jpg)